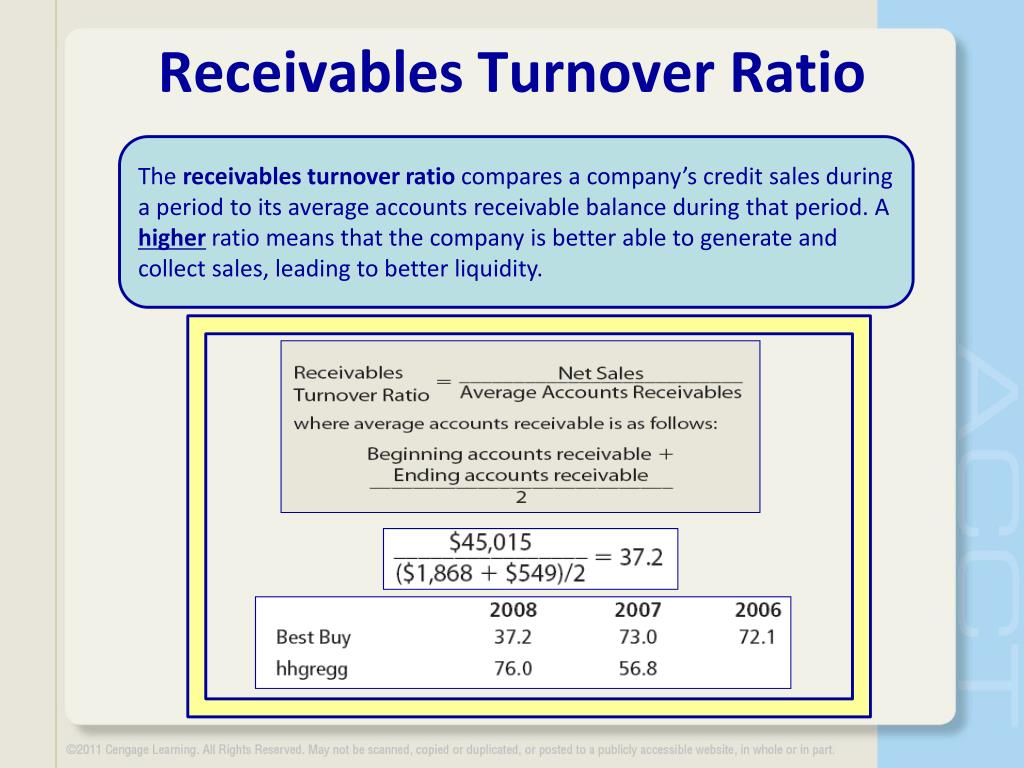

There are also factors that could skew the meaning of a high or low AR turnover ratio, which we’ll cover when discussing the limitations of accounts receivable turnover ratio as a key performance indicator. There's no standard number that distinguishes a “good” AR turnover ratio from a “bad” one, as receivables turnover can vary greatly based on the kind of business you have. What is a good accounts receivable turnover ratio?Ī high accounts receivable turnover ratio is generally preferable as it means you’re collecting your debts more efficiently. But, because collections can vary significantly by business type, it’s always important to look at your turnover ratio in the context of your industry and how it trends over time. This means that on average, it takes their customers about 48 days to pay their invoices (365 ÷ 7.5 = 48).Ĥ5 days and below is what’s considered ideal for your average collection period. ($10 Million Starting Receivables + $14 Million Ending Receivables) ÷ 2 = $12 Million Average Accounts ReceivableĪ turnover ratio of 7.5 would mean that within this period (a year in this instance), Owl Wholesales collected their average receivables 7.5 times.$100 Million Sales on Credit – $10 Million Returns = $90 Million Net Annual Credit Sales.This means Owl Wholesales has a receivables turnover rate of 7.5. Their starting and ending receivables are $10 million and $14 million, which means their average accounts receivable balance is $12 million. Owl Wholesales’ annual credit sales are $90 million ($100 million – $10 million in returns). Here’s an example that illustrates how a company would calculate its accounts receivable turnover ratio. Here is the final accounts receivable turnover ratio formula:Īccounts receivable turnover ratio example This is how you’ll calculate your accounts receivable turnover ratio. Step 3: Divide your net credit sales by average accounts receivableįinally, you’ll divide your net credit sales by your average accounts receivable for the same period. Then, divide the sum by two to get the average. To do this, take the amount you had in AR at the beginning of the accounting period and add it to the amount you had in AR at the end of that period. This looks at the average value of outstanding invoices paid over a specific period. Next, you’ll need to calculate your average accounts receivable. Step 2: Calculate your average accounts receivable You should be able to find this information on your income statement or balance sheet. To do this, take your total sales made on credit and subtract any returns and sales allowances.

To calculate your accounts receivable turnover, you’ll need to determine your net credit sales. Cash sales result in an upfront payment, so these don’t create receivables.

Here are three steps for calculating your accounts receivable turnover ratio: Step 1: Determine your net credit salesįirst, it’s important to note that when measuring receivables turnover, we’re only interested in looking at sales made on credit.

#WHATS A GOOD AR TURNOVER RATIO HOW TO#

How to calculate accounts receivable turnover ratio Businesses hoping to secure funding or receive credit will want to ensure their receivables turnover is in a healthy place.Īccounts receivable turnover ratio also gives companies quick insight into how well their collections team is following up on overdue payments, how effective their credit policies are, and their customer base’s creditworthiness. Some corporate lenders will also look at a businesses’ accounts receivable turnover ratio to assess their financial health. This allows companies to forecast how much cash they’ll have on hand so they can better plan their spending. Finance teams can use AR turnover ratio when making balance sheet forecasts, as it provides a general expectation of when receivables will be paid. Tracking accounts receivable turnover ratio shows you how quickly the company is converting its receivables into cash on an average basis.

It refers to the number of times during a given period (e.g., a month, quarter, or year) the company collected its average accounts receivable. What is accounts receivable turnover ratio and why is it important?Īccounts receivable turnover ratio, also known as receivables turnover ratio or debtor’s turnover ratio, is a measure of efficiency.

0 kommentar(er)

0 kommentar(er)